by Jeanette Fitzsimons

When Solid Energy went belly up with huge debts and failed businesses like its briquetting plant in Southland, the Government was forced to drop it off the list for privatisation because it was no longer fit for sale. Right?

Wrong. Solid Energy has been 46% privatised under our noses without most people realising what was going on.

There was considerable public anger that taxpayers’ money was used to bail out the failed company so it could try to trade its way out of its difficulties. However, part of that deal was persuading the banks who owned much of its debt to write off $75m of that debt in exchange for equity – shares in Solid.

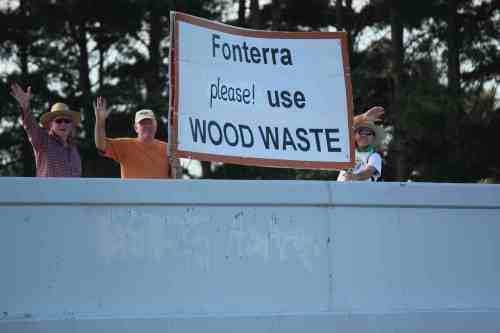

Coal Action Network activist at the now mothballed Mataura briquetting plant – supposed to provide local jobs, but didn’t.

The banks were very reluctant. It wasn’t their idea of a good investment. There is no sign they had any moral qualms about fossil fuels and the future of the planet, nor that they were concerned about the carbon bubble making coal a risky investment. But they should have been.

Both of these factors have caused investment funds overseas, including churches and university pension funds, to divest. Rather, the banks were concerned that the company was a basket case and converting their loans into shares meant they might never see any of it again. They may well be proved right.

Tokyo Bank challenged the debt restructure in the High Court, backed by the other banks, and lost: http://www.interest.co.nz/bonds/68407/bank-tokyo-mitsubishi-take-unsuccessful-solid-energy-debt-restructure-challenge-chin-won

TSB subsequently wrote off the value of its new shareholding, $13.8m, reducing its profit this year by 5.9%: http://www.nbr.co.nz/article/tsb-bank-profit-slips-59-solid-energy-writedown-bd-156961

This much has been reported. However, the net effect on Solid’s ownership is less well known. The effect was to reduce the Crown’s ownership of this former SOE from 100% to 53% – almost exactly what was intended in the initial privatisation plans. The rest, 46%, is owned by the banks, all of them apart from TSB overseas owned. The current shareholding is:

| NZ Govt/taxpayer |

53.38% |

| BNZ |

10.13% |

| The Bank of Tokyo – Mitsubishi UFJ Ltd |

10.13% |

| TSB Bank Limited |

8.55% |

| Westpac New Zealand Limited |

7.03% |

| Commonwealth Bank of Australia |

5.70% |

| ANZ Bank New Zealand Limited |

5.07% |

Why would this matter? Aren’t we better off without a poorly performing coal company that pays no dividends and will eventually have stranded assets? Well, maybe it’s not that simple.

We are in a transition, whether Solid and the Government recognise it or not, from fossil fuels to renewable energy. That transition could be smoother or more bumpy, depending on how Solid Energy is managed.

As long as ministers have the power, as they do for an SOE, to give directions to the board, they can influence that transition in the public interest. (The fact that no government has so far showed any interest in doing so doesn’t take away from the hope that one day they might actually recognise climate change as a problem that requires serious action).

For example, Solid could have been instructed to open no further mines, to manage its existing mines well and pay down its debt, and to put its considerable inventiveness into developing transport fuels based on waste wood rather than lignite – possibly in partnership with Crown-owned Scion. That opportunity has now gone – a 53% majority could not impose that on the rest of the shareholders.

As it happened Solid Energy’s small ventures that would have been in the public interest had they been well managed, and would have helped smooth the transition to a low carbon future – Biodiesel NZ (biogold biodiesel) and Nature’s Flame (wood pellets) – were often conveniently blamed for the SOE’s demise. Two former SE managers now own Biodiesel NZ and are confident of making a profit.

“We are very confident that Green Fuels can provide very competitive pricing in comparison to mineral diesel. Using Biogold™ enables companies and organisations to do the right thing for our environment. A responsible attitude towards sustainability is becoming an increasingly hot topic especially in the current conversations around building a ‘new’ Christchurch and maintaining a ‘pure’ New Zealand.” (http://dieseltalk.co.nz/news/green-fuels-nz-purchases-biodiesel-facilities)

If Solid succeeds in pulling itself out of its hole, a hole that appears to be getting deeper in the face of continued low coal prices that show no sign of rallying, the banks are likely to sell their holdings as soon as they can. This will not be to NZ Mums and Dads, but more likely to overseas investors.

As we’ve pointed out on this blog before, the Indian steel industry has shown considerable interest in our coal assets:

https://coalactionnetworkaotearoa.wordpress.com/2014/03/06/bridges-india-coal/

Handing over a large chunk of these coal assets would create a further vested interest to join other big industries pushing against New Zealand achieving a decent climate policy.

Under modern free trade agreements, and especially under the TPPA if it is signed, foreign investors will have the right to sue our government for any change in policy that impacts on their profits. Goodbye carbon tax, or even a renewed ETS. The TPPA is itself a powerful reason to resist privatisation.

“Privatisation by stealth” is the hackneyed term that comes to mind, but the point here is that we were never told this was the effect of the bailout, but were left to figure it out. More contempt for democracy.

It is hard to see any sensible way forward from here. Coal is a sunset industry and the necessary transition seems likely to be a very bumpy one.